We are expanding the range of products we buy on Amazon more and more. What years ago was reduced to a few items that were difficult to find in physical stores, has now become normal products of daily life that used to be purchased in large stores. The convenience of receiving it at home and the reduction in delivery times that the American multinational has achieved have ended up seducing an increasing number of customers.

And if for the average user of the platform it has gained great value, it has done so even more for certain companies. The platform is aware of this and has developed a series of facilities and services focused on companies. One of them is being able to download and print invoices, a fundamental process for companies and, why not, also for certain standard users.

What do we need to request invoices

To begin with, we must clarify that if we have not registered with the Amazon VAT Calculation Service, we will not be able to access the downloadable VAT invoice option. It is also necessary to add that the process to obtain the VAT depends exclusively on the seller. The American company clarifies that, when we do not have a VAT number issued by a Member State of the European Union, the billing address is the one associated with the payment method. And it adds that we can change the billing address from ‘My account’ if we select ‘My payments’.

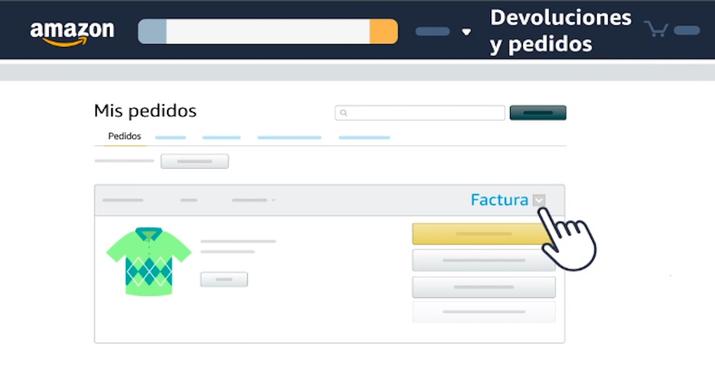

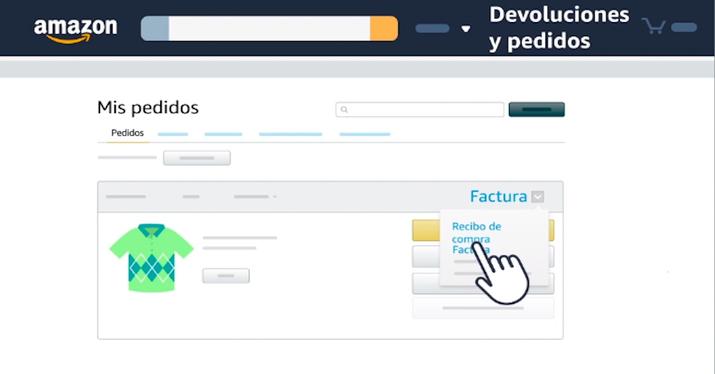

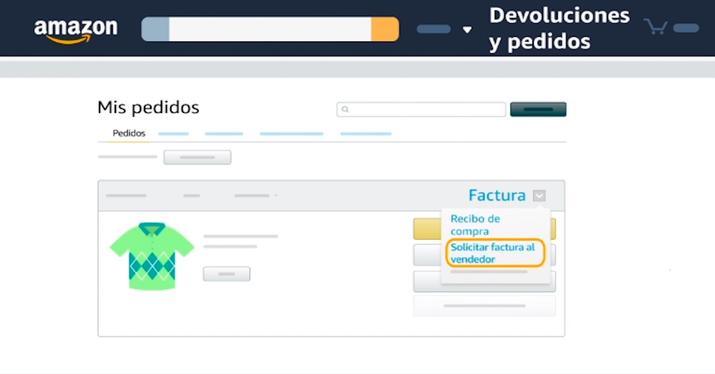

Likewise, the North American company points out that, if we have a VAT number issued by a country of the European Union, the billing address is the one associated with that number. And we can change that billing address from ‘My account’, for which we must choose ‘VAT Number’. When buying an item, therefore, we will have to contact the seller to request it. In the process we go and click on ‘My orders’, where it will be necessary to configure the correct date range. Then go to ‘Invoice’ and then to ‘Request invoice from [nombre del vendedor]’.

There we click on ‘How can the seller help you?’ and we go to ‘An order I made’, to finally select the order for which we want to obtain one. We go to ‘Tell us more about your problem’ and click on ‘Where is my invoice?’, there you can write a message to the seller, which will normally be in the form of an email, although some companies give the option of a more detailed communication. directly via WhatsApp.

It is important to keep in mind that only the buyer of the item will be able to request it. For items sold by the multinational or by those designated as commercial sellers, a PDF invoice can be found in ‘My orders’ or ‘Amazon Business Analytics’.

How to print those invoices

Printing them can be a way to control expenses and be able to justify income before organizations such as the Treasury and even for cases in which we have to make claims for said items. If those products are sold by the platform itself or if you are a commercial seller, follow these steps to print them:

We start by going to ‘My account’ and then go to ‘My orders’. There we open the ‘Last 6 months’ dropdown menu by default to choose a year or use the search box. We go to ‘Invoice’ (it is located under the order number) and, depending on the seller with whom we have placed the order, we can perform one of the following actions:

If the order is purchased directly from Amazon, we should be able to print one for the order. We will see an option to print and you can also print an order summary by selecting ‘Order Summary’. If we place an order with a Marketplace seller enrolled in the VAT calculation service, one is available in ‘My Orders’ by simply clicking Print.

But you can also print an order summary by selecting ‘Order summary’. If we cannot see it in ‘My orders’, we must contact the seller directly to request one by selecting ‘Request invoice’. On the same page, we click on ‘Print this page for my records’.

Request and download invoices on Amazon Business

For orders that have been sold and shipped by Amazon and paid for with an individual payment method, we can find a printable version in ‘My Account’. The same if what we have acquired are digital products or services. If that order went to a seller managed by the company, to obtain it with VAT on the items that the multinational itself manages and ships, we will have to contact the sellers directly.

In the same way we will have to communicate with the seller if the purchased product was sold and shipped by a Marketplace seller. To apply as an Administrator, we can find a printable version of all orders in ‘My Account’ for all sold orders. We again point out that a VAT invoice for an item sold and shipped by a seller or Marketplace, the orderer must contact the seller to request it.

Requirements in Amazon Business

From the multinational they clarify that, if the company has a VAT number, we will need to register it in our Amazon Business account. To do this, they will invite you to enter a VAT number when we make that account.

By entering the VAT data we will already ensure that we pay the correct VAT. It also allows them to apply an import duty deposit to our purchase, if necessary, so that they can pay customer taxes on our behalf.

For zero-rate VAT to apply to intra-community transactions, the EU VAT number must be in the European Commission’s VAT Information Exchange System (VIES). A local VAT number not listed in VIES will be provided, however, local VAT numbers will not allow the company to exempt from VAT purchases of products fulfilled from another EU country.

If our company operates in more than one country, it is necessary to enter the VAT number and the address of each country in which we operate. It may take three to four business days for them to verify that number, so they recommend that we wait until they verify our VAT number before starting to make purchases. To do this, they will send us an email when they verify our number.

Frequent problems

As in any online process, problems may arise, mostly minor, when carrying out a process and even request certain services. Keep in mind that items purchased in American retail sometimes do not include VAT because they can be imported from outside our country and the European Union. Import process VAT and customs duties are paid as described in the Amazon Global Store terms and conditions.

Gifts

If the order was a gift, we will not be able to print an invoice from ‘My account’ and if we need it with VAT for a gift order, we contact Amazon and they will send it to us. Something similar happens with gift cards, as the company cannot provide detailed information with VAT for them. However, a summary for gift card orders can be printed from ‘My orders’.

second hand items

In this case we will not be able to print one from ‘My Account’ either, the solution would also be to contact Amazon and they will issue one. They also cannot provide it with VAT for an order until it is shipped. After being shipped, a printable version can be found in ‘My Account’ for platform orders.