Nobody can deny the effect that Digi’s strategy is having in the Spanish market. Since they “got the batteries” with the combined packages of fiber and mobile or began to deploy their own coverage, the Romanian operator is growing by leaps and bounds. Now, in addition to the information that they offered us a few weeks ago, we have the official data from the National Commission for Markets and Competition that shows us the Digi effect on Movistar, Orange, Vodafone or MásMóvil customers.

The latest data we had from Digi told us about the best historical data on portability harvested in March. The operator achieved more than 124,600, 31% more than in 2022. In the first quarter of the year the accumulated figure reached more than 289,700 portability with 95,200 net mobile and fixed telephone lines. In total, they have more than 3,796,000 mobile telephony customers, more than 843,000 fiber and more than 279,000 fixed telephony.

Digi’s effect on direct competition

However, we were missing something to evaluate those figures and that is the effect on competition. To do this, we use the latest official data published by the CNMC corresponding to the last quarter of the year 2022. In addition to seeing that, we have verified that the income of retail services, with 6,213 million euros, rose 1.2% compared to to those of the same period of 2021 or that 83.1% of the total broadband lines were fiber.

The most relevant thing is that the combined market share of Movistar, Vodafone and Orange continued to fall both in mobile telephony (-2.1 points) and in fixed broadband (-3.4 points). Movistar has 41.4% of the income, Orange 15.7% and Vodafone 14.4% of the total. The MásMóvil Group remains with 10.1%. We do not have specific data from Digi in this official publication.

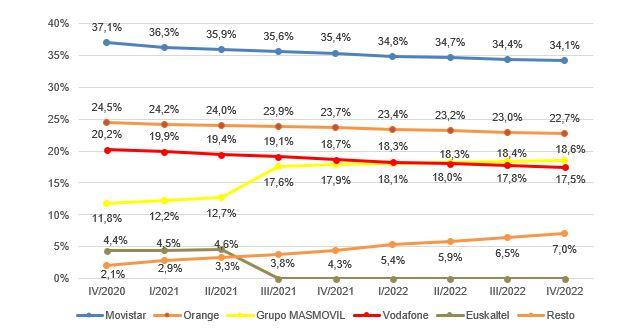

Regarding the share of fixed broadband lines, we see Digi’s impact on the rest of the operators. Movistar has gone from 37.1% in 2020 to 34.1% in 2022, that is, three percentage points less. Orange falls from 24.5% to 22.7%, slightly less than two points in these two years. Vodafone goes from 20.2% to 17.5%, a drop also close to three percent.

Finally, the MásMóvil Group is the least affected. In fact, it grows from the 16.2% it had together with Euskaltel in 2020 to the 18.6% it has at the end of 2022. The yellow company of the four network operators that does not see its fixed broadband market share fall . For their part, the rest of the operators, driven by Digi, went from 2.1% in 2020 to 7% in 2022.

And now that?

From here it is difficult to determine the future of the market. We know that, if nothing happens, Orange and MásMóvil will combine their business in 2023. This will keep them with 41.5% of fixed broadband lines. This number may not be as high due to possible restrictions imposed by Brussels, but it will still be the market leader.

Movistar will follow, while Vodafone will have to find a way to remain relevant with its HFC network, which falls somewhat short of competing with the competition’s FTTH networks. Meanwhile, Digi will have grown even more since the CNMC figures are from the end of 2022 and the first quarter of 2023 has been a record for them.