The Tax Agency is known for, among many other aspects, carefully pursuing all debtors using different techniques to do so. However, below this figure, you should not worry, according to the resolution published in the BOE itself in 2022.

Every year, for a decade, the Tax Agency has published a list that includes the names of all the people, and their responsible parties, who have debts in our country. For our name to be present on it, the amount owed must be greater than 600,000. And in the one published in the year 2023, which included all those people who owed an amount greater than this amount as of December 31, 2022, a total of 6,076 taxpayers were included. 13.7% less than the same list of the previous year.

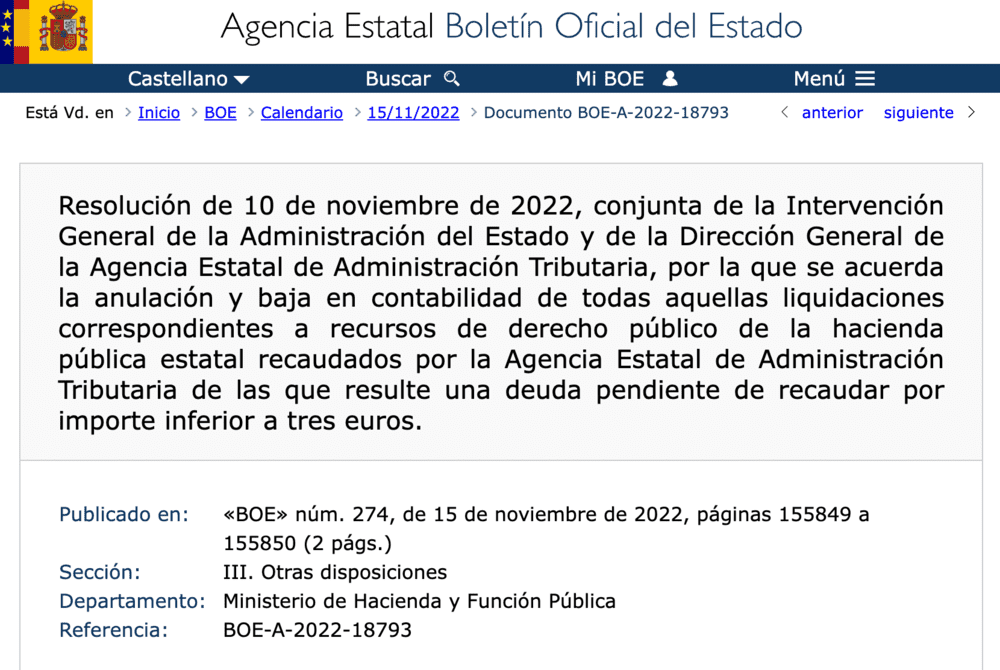

However, the Tax Agency also pursues all those debts that have a lower amount, with regardless of the reason that caused them. However, due to the amount involved, the names of all those present are not made public. However, this does not exclude that, ultimately, the different mechanisms can be activated to collect the money owed. However, this does not happen if our debt does not exceed a minimum amount for which the agency considers that it is not profitable to pursue the debtor, as is as published in the BOE on November 15, 2022.

Three euros of debt

According to the information that appears in the previously mentioned document, “It is agreed to cancel and deregister all those settlements corresponding to public law resources of the state public treasury collected by the State Tax Administration Agency that result in a debt pending collection for an amount of less than three euros.”.

Through this action, it is “avoid collection actions that presuppose zero benefit for the Public Treasury or for the fulfillment of the purposes entrusted to the Public Administration. This is the case of settlements whose levy generates costs greater than the resources that could potentially be derived from those”.

That is, the organism understands that by pursuing those debts that have a lower value than what we have mentioned, it is not profitable to activate all the mechanisms and tools involved in claiming debts.

What happens if we do not pay a debt with the Treasury

In the event that the amount owed is greater than that previously mentioned, the Treasury will begin an executive process in the event that we have not paid the agreed amount within the voluntary period. When this period begins, The debt will increase as a surcharge, Therefore, it is advisable to avoid reaching this situation.

Ultimately, it is possible that a enforcement procedure will be initiated in which the Tax Agency collects the debts due and not satisfied in the voluntary payment period through the “execution of the debtor’s assets for the collection of debts“, as the organization itself states in his web page.