For a few days now, a good part of the citizens in this country have begun to prepare the Income Tax return for the year 2023. Many are required to present it to the Tax Agency to comply with their annual obligations.

The truth is that there are citizens for whom this tax return is worth paying, while for others it is refundable. It all depends on multiple factors related to our income in the past calendar year. While some have advanced knowledge when preparing this declaration to present to the Treasury, others have very limited knowledge.

However, we have multiple aids that we find on the Internet, for example, to save and get a little more money returned to us, or pay less in said declaration. Of course, we also have the possibility of going to a specialist such as a financial manager to give us a hand. If you have made the decision to fill out your 2023 Income on your own, perhaps this help that we are going to tell you will be very useful to you.

We tell you all this because the Tax Agency itself, once the submission period has begun, presents us with the Practical Income Manual 2023. Among many other helps and advice that we can find here when designing our return, we see all the deductions that we can include both at a general level and by communities.

Income deductions 2023 to pay less

To take a look at all the benefits that we can use when designing our 2023 Income, it is recommended that we access the Tax Agency’s Practical Income 2023 Manual. We can access it directly from our browser through this link.

At this point it is worth mentioning that in the left panel we find a series of chapters that will be of enormous help when optimizing our 2023 Income Tax return. If you are preparing it yourself, we recommend that you take a look to each and every one of the sections presented here.

Perhaps the most recurring and the ones that will be most useful to you are the two chapters especially focused on the deductions from which we can benefit. To do this we will have to focus on chapters 16 and 17 of the manual that we have mentioned. The first of them refers to all the general deductions that we can access and that will benefit us in one way or another. All we have to do is click on the corresponding link.

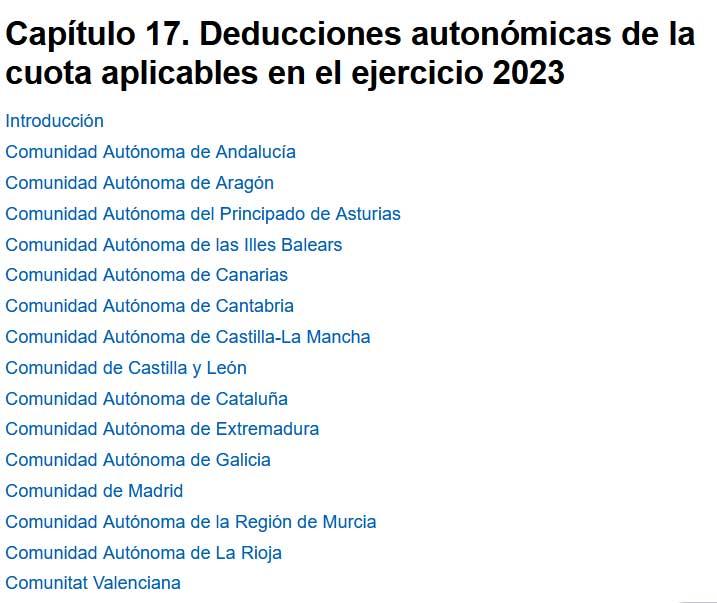

On the other hand, we also recommend that you take a look at the possible deductions that you can use corresponding to the different Autonomous Communities.

We find all of this in detail in chapter 17, where these deductions are detailed depending on the region in which we are registered. Depending on the situation of each citizen, we may benefit from some deductions or others, but the important thing here is to know them all and to know those to which we are entitled, even for the area in which we live.