Apple Pay privacy: that’s how it is with security

Apple Pay works on all Apple devices in combination with a bank that Apple works with. The payment service is nothing but a virtual pass that is on your iPhone, iPad, Apple Watch and Mac. But does this mean that Apple can look into your transactions? What about using NFC? In this article you can read everything about Apple Pay and privacy.

- Privacy when setting up

- Payment security

- Is Apple Pay safe?

- Apple and data

- Device stolen

Privacy when setting up

As soon as you add your first card to the Wallet app to use Apple Pay, the app encrypts the necessary information from your card (such as IBAN and unique card number) and sends it to the Apple servers. Apple decrypts the data, checks only the payment network and re-encrypts the data. This encrypted information can only be unlocked by the payment network. This means that only your bank can view this information to check whether the card is suitable for Apple Pay.

After this check, the bank creates a so-called device account number for your card. This number is unique to the card and device on which it is set. This number is also sent encrypted to Apple. Apple cannot see this number and data. Your device account number is stored locally in the Secure Enclave, a secure part in your Apple device that can only be read by the device itself. This number is also not stored in iCloud.

Apple does carry out some checks to see if you qualify. Your device sends some device settings and usage patterns to Apple. For example, consider the percentage of time the device is in motion or the approximate number of calls you make per week. With this, Apple prevents abuse of Apple Pay. Otherwise, criminals could automatically enable Apple Pay on a large number of devices at the same time. Apple only uses this to check your eligibility and has no insight into who you call or other information.

Payment security: that’s how it works

When you use Apple Pay in stores, on the web, and in apps, you must confirm each payment with a verification. On an iPhone without a home button that is Face ID, on a device with a home button you use Touch ID. If that doesn’t work, you use an access code to confirm your payment. This means that no one can simply make a payment with your iPhone, iPad or Mac, because verification is always required. Verification is also required for amounts smaller than €25.

On the Apple Watch, it is required to set a passcode and enable wear detection. That means if you take off your Apple Watch, no one else can make a payment with it until the passcode is entered or the paired iPhone is unlocked.

Apple Pay uses NFC for payments. NFC only works at short distances and can therefore not be read at great distances. Because you always have to verify first (with Touch ID, Face ID or pressing the side button twice on the Apple Watch), your device cannot be secretly read with a mobile pin device.

Is Apple Pay safe?

Despite all these measures, fraud with Apple Pay is still possible. Bots are used to intercept the authentication code when adding a new card. These codes are often sent via SMS, a method that has long been known to be unsafe.

The hack works as follows: the owner of the bank card or credit card receives a one-time code from the bank via a phone call or text message. That code must be entered to activate Apple Pay. However, the code never reaches the owner, but is captured and forwarded to the hacker. For example, your payment card can be linked to someone else’s iPhone unnoticed.

Normally, banks and credit card companies take action if there are suspicious transactions, for example if a Dutch credit card is suddenly used for large amounts in Thailand. In this case, the fraud is harder to track down because Apple Pay is so well sealed up. Apple does not know what you buy and immediately forwards all data to VISA and Mastercard. The bank that issued the credit card (for example ABN or ING) receives very little payment information, so that the normal anti-fraud measures work less well. You can read all the information about this form of Apple Pay fraud in the article below. You can guard against it by enabling notifications for every transaction, so you can thwart any further abuse right away.

Apple and data: This information is shared

Apple does not retain original card numbers for any card. Apple therefore has no access to these numbers. Only part of the number is saved (for example the last digits of your IBAN) in order to recognize the card. They are linked to your Apple ID, so you can easily add them all to your devices.

Apple also has no insight into your transaction information. All payments are regular debit card payments and therefore also use the same security standards. The information about what you buy and how much you spend does not end up with Apple. All transactions remain between you, the merchant and the processing bank.

In short: this data is not visible to Apple and are also not stored:

- Original credit, debit and prepaid card numbers.

- Transaction information, such as stores and purchases.

- IBAN bank account.

- Device account number, to set up your card and process payments. This is securely stored on the Secure Enclave.

This data can well stored by Apple and can be shared with the card issuer:

- Device settings and device usage patterns. This is to check when setting up and to prevent fraud.

- Transaction data when paying via apps and on the web. This data is anonymized. This includes the approximate purchase amount, the app developer and the name of the app. This data is used to improve the services.

The Wallet app does show the last transactions you made with the Apple Pay card. This information is not in iCloud and is therefore not synchronized with other devices. You will only see an overview of payments made with that specific device. If you want to see all payments, check your bank’s app.

You can read more information about privacy in Apple’s support article.

What can I do if my device is stolen?

If your iPhone, iPad, Apple Watch or Mac is stolen, you can remove your cards remotely. You then prevent someone who knows your access code from making illegal payments. This works like this:

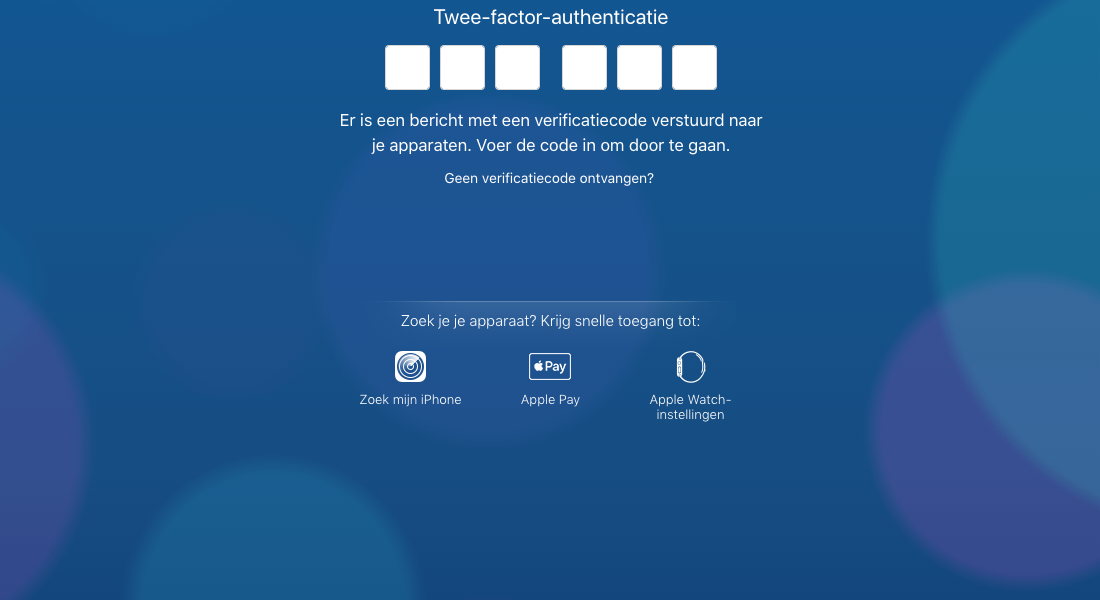

- Go to https://www.icloud.com and sign in with your Apple ID.

- If you get a notification for the verification code for two-factor authentication, you can ignore it. Click the Apple Pay logo at the bottom. If you don’t see this, go to the Settings app on the iCloud website.

- You will now see an overview of your devices. Choose the device that was stolen. On the left side you see an overview of your passes. Click Remove All.

Another way to block Apple Pay is to enable Lost Mode through Find My iPhone. You can read more about this in our guide.

ING recommends that you also block your Mobile Banking app via Mijn ING. The bank also advises calling the emergency line.

For more answers to frequently asked questions about Apple Pay, read our Apple Pay FAQ.

Also read our other articles about Apple Pay:

- Apple Pay FAQ: frequently asked questions about Apple’s payment service

- Set up Apple Pay on your iPhone, Apple Watch and more: this is how you do it

- For example, you can pay with Apple Pay in stores, apps, and on the web

- Which stores accept Apple Pay?

- Apple Pay available immediately at ING: you need to know this

- Apple Pay: the complete overview of Apple’s payment service