Economic hardship is something that is more widespread among many families in our country than we would like. Many, instead of going to banks as has been done for decades, prefer to ask a family member for a loan.

The truth is that the economy at the moment is not for too many excesses, even having a job, many have difficulties making ends meet. This is not to mention the possible unforeseen events and economic expenses that can appear suddenly and that we cannot afford. This is something that has been going on for a long time, but that we should now formalize in some way.

Surely on many occasions some of you have asked a family member or friend for a loan and have formalized it out loud. However, we live in times in which it is always better to have a role in front of you in order to avoid problems of all kinds. In this way we prevent any of the two parties from breaking the agreement in the future, no matter how confident they are, with the problems that all this can cause.

Actually, what we are talking about is filling out a prior form or contract if we are going to borrow or lend money to a family member or friend. Despite the fact that there is a lot of trust, or precisely because of it, if the agreement is on paper and signed, all the better. Both the collector and the payer in most cases will feel calmer and both make sure they comply with the previously stipulated conditions.

How to formalize a loan between family members

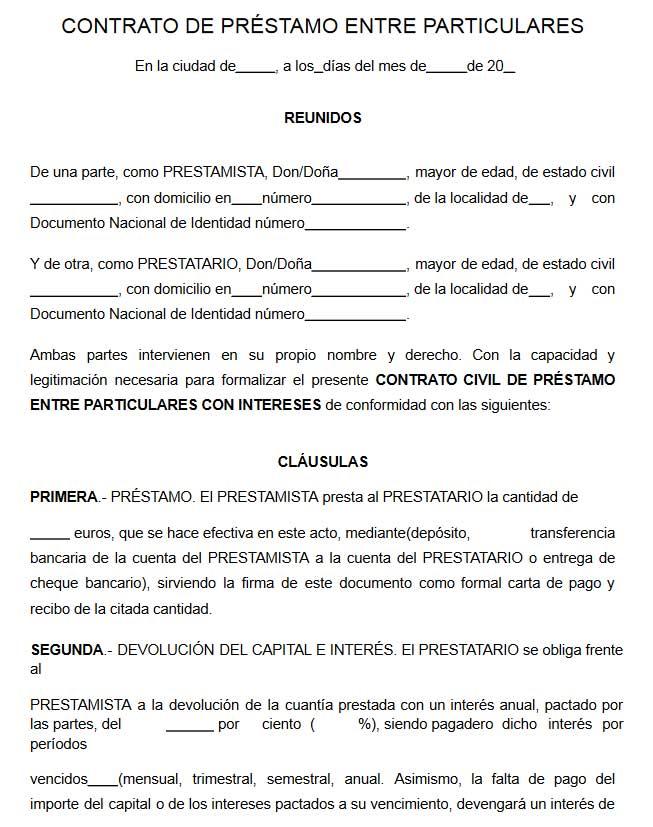

Basically what we mean by all this is that before making a loan, even to a relative or friend, we fill out the contract that we will show you below. Thus, in order to formalize a loan with a relative, it is best that we draw up a loan contract through a private document between the two parties. Although we can do it, it is not necessary that we go to a notary who will charge us money to formalize this.

At first it is assumed that we will never have to use this contract, but just in case, it should always include the date, place and interest related to the loan. It is likely that in most cases this loan between family members is carried out without any interest involved. Therefore, below, we are going to show you a contract that you can download both in PDF format and in the form of a Word document, where you can establish all the data that we are discussing.

We can both models download from this website, where we will have to fill in the form with all its corresponding data and sign it. As we mentioned before, this is a model that allows us to establish a certain interest percentage, or simply leave it at zero. Once we have completed the requested data, either in digital or paper format, each party should keep a signed copy of this contract.

So if in the future there are problems in the repayment of the loan, we will have this document to carry out the pertinent judicial processes.