The new year 2023 began a few weeks ago, and as usual on these dates, we are going to find all kinds of changes over the next 12 months. In the event that you are a self-employed worker, the payment of the fee will also undergo some important changes.

It is true that up to now there is still a lot of uncertainty and confusion regarding these changes in the self-employment rates that are going to take place in the coming months. There will be several sections that will have a direct influence, such as the net income of each one, for this new contribution base. It is to be hoped that we will find out about all this and things will become clearer as Social Security informs more specifically.

In the same way, the different administrations and agencies especially dedicated to these tasks, are underway to satisfy the doubts of their clients. This is a new system that will be rolled out over the next few months and one that we will have to get used to in the coming years. With everything and with this, we are going to show you a solution that will help you to clarify things a little more in this regard. Specifically, we are referring to a useful calculator that will help you calculate how much you will have to pay to Social Security for the self-employment rate in this year 2023.

Of course, we must bear in mind that the web and its corresponding calculator that we will talk about below is merely informative. This is something that Social Security itself wants to clarify for all those who make use of it.

Calculate your freelance quota in 2023

And it is that we must take into account that the calculator that we will show you below is offered by Social Security itself from its official website. Therefore, to get an idea of the freelance fee that we are going to have to pay from now on based on our contribution, at first we will only have to run our favorite Internet browser. Then today we will have to open the website enabled by Social Security for these particular calculations.

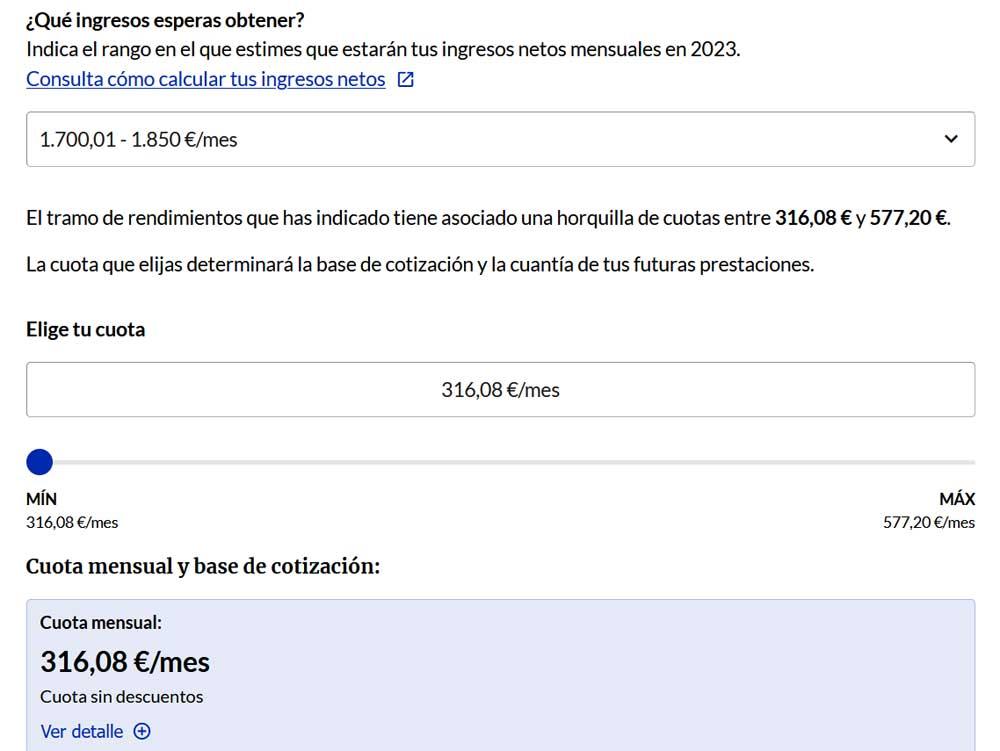

Once we have located ourselves on the aforementioned website, we will only have to choose the section of net income that we expect to have that month from the drop-down list that we find. At that moment, the calculation will be carried out automatically and so we can see first-hand the self-employed fee that we are going to pay based on that income. In addition, we will have the possibility of breaking down that payment just by clicking on the link that says See details.

In this way and with this simple calculator that Social Security itself offers us, we will have the possibility, in a matter of seconds, of getting an idea of how much we will have to pay with respect to the self-employment rate that month. This way we avoid surprises and we will be able to make our own estimates for when the bill arrives the following current month, once we know our approximate income.