Form 037 is used to register in the census declaration, modify some data or, once the activity is completed, proceed to cancel it. Due to its characteristics and the target audience, it is common to confuse it with the 036 model. However, it has important differences that you should be aware of.

The Tax agency We have at our disposal a wide variety of models that are used to carry out different actions. Among them, registering as self-employed to be able to regularize our situation before starting to bill. In this article, we are going to tell you what is model 037, What is it for and how to fill it. In addition, we also analyze some of the main differences compared to the 036 model. Below we tell you everything you need to know about it.

What is model 037 and what is it for?

Once the introduction has been made, we move on to define What is model 037. It is, as we have already mentioned, a simplified census declaration that serves us not only to register, but also to make changes or even communicate our withdrawal once we cease professional activity in the business census.

It is necessary to make this model when we are going to start our professional activity. Since it will allow us to comply with tax obligations regarding census matters before the Spanish Tax Agency. The main functions of this model.

As with the rest of the models, it acts as a tool that allows us to communicate with the AEAT and provide all the information that is necessary for the start of any activity, such as our personal data, the type of activity to be carried out. and the taxes or withholdings that must be taken into account for the corresponding exercise of said activity.

Contrary to what happens with other models, such as the 303, in this case there is no specific calendar for its presentation. The only requirement is to register when we have decided to start our activity, regardless of the time of year in which it occurs.

Who should submit it

He model 037 It must be presented, as we have already mentioned, by businessmen or professionals who are going to begin the exercise of one or more economic activities within Spanish territory. In order to present it, the following characteristics must be met, among others:

- Be a resident in Spain and have been assigned a NIF (Tax Identification Number).

- Not having the status of a large company.

- Do not act through a representative.

- Do not make remote sales.

- Not satisfying capital gains.

- That your tax address coincides with that of administrative management.

- Not be registered in the Registry of intra-community operators or in the Monthly VAT Refund Registry.

What is the difference between model 036 and model 037?

It is common to have certain doubts when presenting the model, since both 037 and 036 They have quite a few similarities between them. However, they also have differences both in the form and objectives of the presentation. Mainly, because 036 is much longer. Although in many cases, 037 is more than enough to start our activity. We tell you five differences:

- Audience: Form 036 is aimed at both self-employed workers and companies, covering a broader range of taxpayers. On the other hand, form 037 is intended exclusively for self-employed workers, so it cannot be used to register a company.

- Action by representative: It is common for self-employed people and entrepreneurs to have hired managers who can carry out the procedures on their behalf. In this case, the possibility of acting through a legal representative is only available in form 036. In form 037, the interested party must always act.

- Tax residence: In form 037, it is required that the tax address coincides with the administrative management address. In the case of model 036, both addresses can be different.

- Special VAT regimes: Form 036 allows registration in various special VAT regimes. Model 037 cannot do the same.

- International operations: Model 037 can only be used to operate within the national territory. It is not possible to carry out these operations with companies that are located outside the European Community.

Filling out form 037

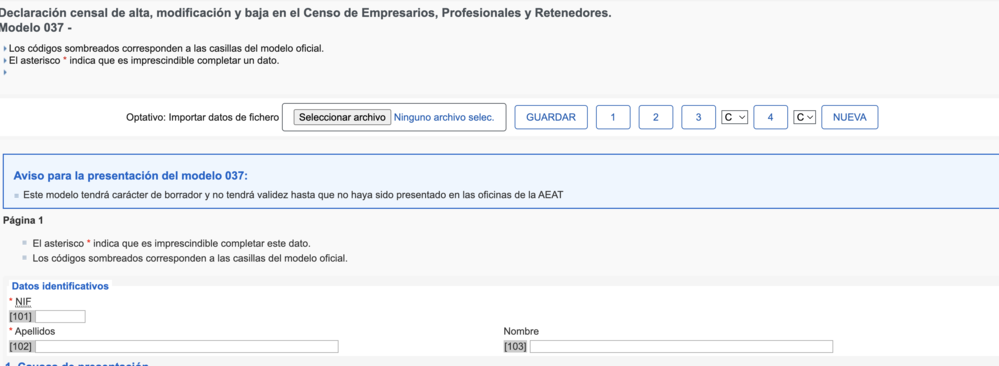

We must access, first of all, to this link to proceed with its completion. When we access the document, we will see how it is much shorter than model 036. In this case, it has three pages, which must be filled out as follows:

- Page 1: We must indicate whether it is a registration, a cancellation or a modification of the data that we had previously presented.

- Page 2: On the next page, we must select the method of determining the applicable income tax return and then mark the option corresponding to the VAT Regime. At this point, we must also add the date and heading of the activity in question.

- Page 3: On the last page, we must enter the data of the activity to register or cancel.

As in the rest of the models, the 037 can be present both electronically as physically attending to an office of the Tax Agency. In the first case, we can sign it both through an electronic certificate and through the Cl@ve PIN system. In the second case, we will have to request an appointment and, when the day comes, deliver the document in question.