Insurance companies or those financial institutions that have this commercial objective generally handle premiums in their different characteristics. That is why in this article we will talk about what the net, gross or pure premium is and its types as calculation examples.

What is a cousin?

Before starting, we want to emphasize that this term covers very broad aspects in the economic framework, so we will give it a generic concept. A premium is the monetary amount that is given to a person and institution, responding to parameters of compensation and encouragement in a particular action. In general, it is about the acquisition of contracts or agreements that imply the bonus for certain wealth or services.

In short, the premium is the cancellation of an additional payment in certain operations and commercial transactions, which is accompanied by a main payment.

What is a net premium?

The net premium is a net amount charged by an insurer to address a single risk. Likewise, you can calculate the total premium to pay for the insurance of certain goods, such as a car, establishing a budget from the insurer with the buyer. In the end, the member will be able to have a balance to be paid to the insurer exactly and that will be fixed or proportional.

What is a Pure Prime?

In the economic system, a pure premium is one whose risk value is predicted, based on a premise that has a statistical and financial reference. Likewise, the statistics guide towards precise capitals that will be owed to the insurers, while the financial one is the interest obtained for an investment. These pure premiums are based on six factors or elements that identify or accompany them, we will show you briefly below.

- Probability.

- Risk.

- Time frame.

- Sum assured.

- Insurance duration.

-

Interest rate.

What are the types of insurance premiums?

Next, we will show you what the different premiums are, we will explain the two classifications, first by their structure and then by their payment method.

Premiums according to their structure

-

Pure Premium: As we mentioned before, the pure premium is one that has a curvature of value based on the risk that the insurer takes. Based on the calculation of probabilities, which coincide with the payment received by the insurer

-

Inventory bonus: This represents the effect added to the pure bonus of the organization’s internal administration payments.

-

Quota premium: This is acquired through an increase in the inventory of internal administration expenses in a company. This is well known as we mentioned in previous paragraphs as gross or commercial premium.

-

Total Premium: This belongs to the insured who have to make the payments according to the receipts, it is the result of adding taxes and altered legal surcharges.

Well we have already considered as a summary of what was explained at the beginning the structure of the premiums, now let’s see the form of premium payment.

Response to payment method

-

Single premium: This is made as a single payment.

-

Regular Premium: This is the one that is settled periodically, and that usually has a certain period of time in a contract.

-

Segmented premium: In this particular the premium is divided, and that has been calculated to be paid in different annual periods.

-

Fractional premium: This premium is very similar to the segmented or fractional premium, with the only difference being that it is paid in less than one year.

Example of calculation and premium formula in a company

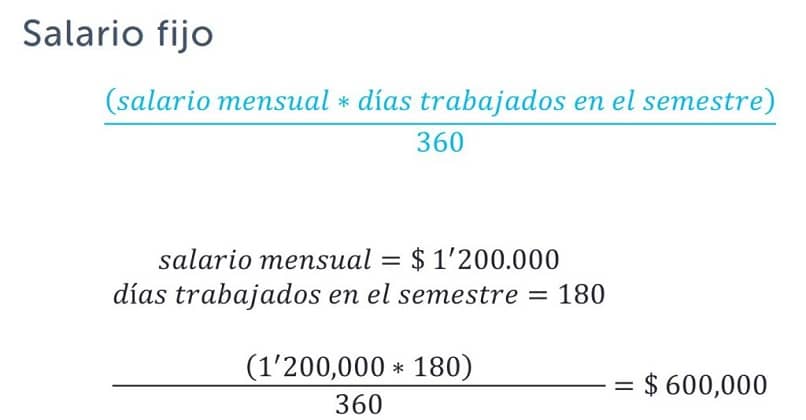

Let’s analyze an example of a worker, let’s say that this person begins his work in a company on June 1, 2020. Said worker receives an annual salary of $1,200,000, and the time has come when the premium must be canceled. It corresponds to you semi-annually.

Until the month of December, the worker has already been working for 6 months, within the company, here we use this formula. And although the service premiums are granted on December 20, they are canceled on the 31st of the month, unless the employee retires earlier.