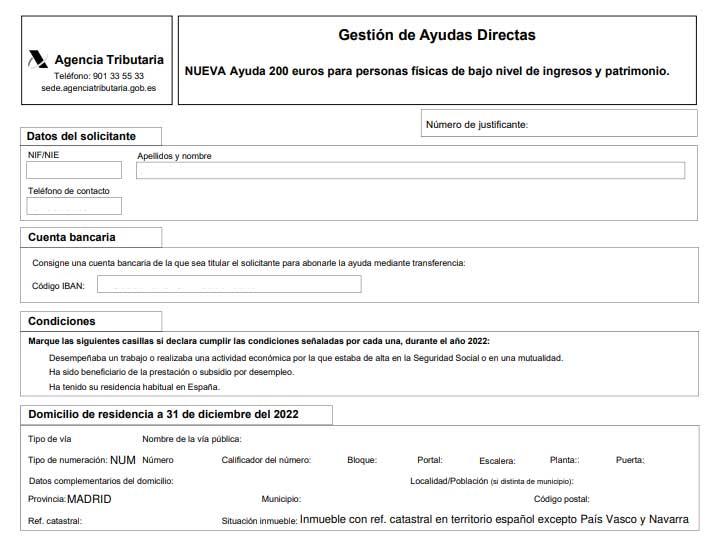

Since yesterday, February 15, 2023, many families and citizens of this country have requested the new aid of 200 euros from the government. For this we must meet a series of requirements, although we can also find some subsequent drawbacks that we have not taken into consideration.

We must bear in mind that there are many families and citizens who are currently in a somewhat delicate situation for various reasons. Unemployment rates are very high and also finding work is becoming more and more complicated. To all this we can add that the prices of basic products are increasingly higher and are far from what many can afford. Hence precisely the aid approved by the Council of Ministers on December 27. We are specifically referring to the new initiatives that seek to respond to the consequences that the war in Ukraine is having on the economy.

Hence precisely the gradual rise in prices of all kinds of basic consumer products. Therefore, and in order to protect part of the citizens in our country, with special emphasis on the most vulnerable, the launch of a new extraordinary subscription. This is made up of a total of 200 euros that could be requested from yesterday, February 15, 2023. It is worth mentioning that we have the possibility of carrying out this request until next March 31, 2023.

During this period, millions of families and citizens in our country will surely ask the government for this help, although not all cases are valid.

Disadvantages of the aid of 200 euros

To access this aid we have to meet a series of essential requirements such as not having exceeded a full income of 27,000 euros in the past year. In turn, we must have assets of less than 75,000 euros, where our habitual residence does not come into play. If you think you are a candidate to receive this social bonus, you can do so through the page corresponding to the official website of the Tax Agency.

However, first of all, we must take into account some sections referring to this aid of 200 euros that have not been made so widely known. The first thing we should know is that this bonus, if we finally receive it, we will have to declare it in next year’s tax return. Basically this means that those 200 euros will be taxed as earnings in our 2024 income statement.

On the other hand, an aspect that we must also take into consideration and that is somewhat striking, is the exclusion of this aid for those who are now collecting the IMV or minimum vital income. The strange thing about this measure is that precisely those who receive this aid are possibly the most needy at the moment, but they do not have access to this new 200-euro bonus.

In the event that at first we do not meet the requirements, we have one month to present the corresponding allegations, otherwise we will lose the opportunity.