The economy of most families right now is not going through its best moment. Prices do not stop rising in all kinds of products and services, which little by little is suffocating almost everyone. This is something that is especially evident in the mortgage that we have contracted to pay for our house.

After the significant rise that interest rates are receiving lately in this regard, many mortgagees are seeing how their monthly payment has risen significantly. If to date we already had problems paying this mortgage loan, things are getting worse. How could it be otherwise, all of this directly affects the economy, drowning more and more those who are mortgaged.

Now the Government is going to offer help to try to alleviate those people who cannot afford these expenses at this time to pay for their home. With this, what is intended is to counteract the sharp increase in the price of variable-rate mortgages. All of this is due to the rate hikes by the European Central Bank. For all this, a plan has now been agreed that includes some relief measures for mortgaged citizens. This includes the possible adoption of a grace period, for example.

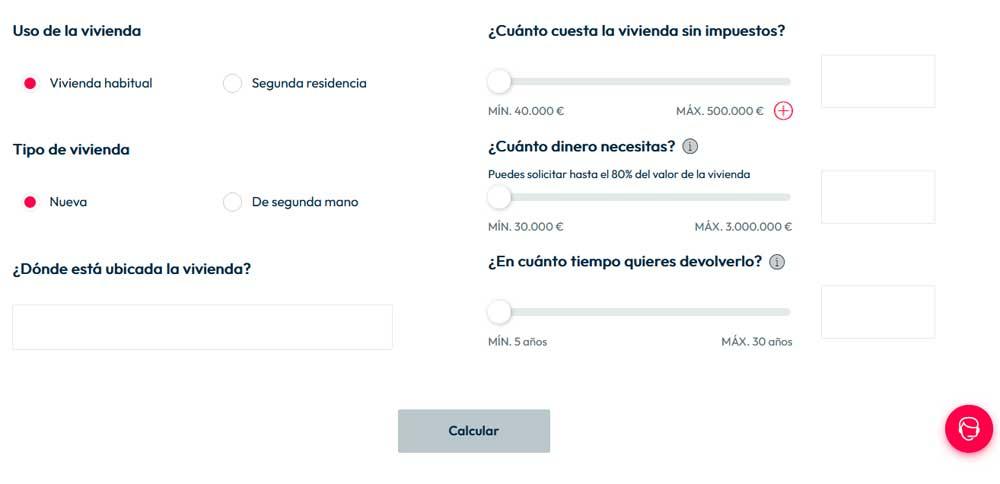

In this way, the beneficiaries will only pay the interest on the mortgage, saving the rest of the installment, all over the next 5 years. Another measure that may be of interest to many in order to lower the monthly fee is the possibility of extending the mortgage up to a duration of 40 years.

So you know if you can access this mortgage help

The important thing here is that to access these aids we must first meet a series of requirements. To begin with, households with an income of less than 29,400 euros per year will have the possibility of accessing this mortgage assistance. To this is added that more than 30% of your income will go to pay the mortgage. In addition, another requirement that we must meet is that, to benefit from this aid, said quota must have recently increased by at least 20%.

Although it may not seem like it at first, more than a million families in our country are expected to be in a position to benefit from all of this. Of course, we must take into account that this economic relief for families that can benefit from all this is temporary. In the long term we will end up paying a greater total amount of the mortgage due to the aforementioned 5-year grace period. First of all, we must know that this aid will come into force as of January 1, 2023.

And it is clear that, as the years to be paid increase, the long-term interest will also increase, which negatively affects the total amount that we will finally pay for our mortgage. On the contrary, if we see it in the short term, for many it will be a relief until better times come, or so we hope.

Likewise, we will tell you that there are still certain banking entities that are pending to sign the agreement, since the last fringes are still being negotiated. This includes banks as important as Santander, BBVA and CaixaBank.