Over the years, everything related to electronic commerce has gained both reliability and security for users. Today we have enormous protection and secure platforms to make our payments online.

These methods are implemented in most current stores by default so that we can choose the payment method that interests us the most without taking risks. But it is also true that there are many who still mistrust these platforms and are reluctant to introduce their usual bank card. It is true that we have intermediaries that offer us even more security, such as PayPal, among other similar proposals.

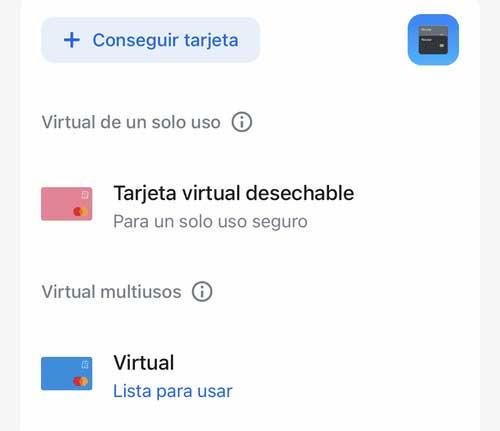

But at the same time we can use other alternatives so as not to take risks when we make purchases on the Internet. Specifically, we are referring to the possibility of using certain virtual cards so that we do not have to introduce the ones we normally use in these stores. One of the main advantages offered by the virtual cards that we are referring to here is that we can recharge them with the amount to be paid and thus there is no possibility of being robbed.

As you can imagine, this is how we avoid using the card that we have linked to our bank account and where we have our savings. It is for all this that we will talk about some of these virtual cards that you can contract right now and thus avoid risks in online purchases.

revolt

Here we are before one of the most used proposals of this type and that has been with us for quite some time. It is a card that has a fee of zero euros at the moment, we will only have to pay a total of 6 euros for its shipment. It is a perfect option to pay online since we can recharge it from 10 euros with our mobile at no cost. Of course, we need to open an account in the banking entity to have this virtual card.

virtual card N26

Secondly, we will talk about a mastercard virtual card to pay online without commissions. In addition, it has support so that we can use it through popular platforms such as Apple Pay or Google Pay and thus pay with the mobile. It is worth noting that this virtual card gives us the opportunity to withdraw cash at ATMs that have NFC support up to three times a month at no cost.

BBVA

This is one banking entity of those of a lifetime that also gives us the possibility of benefiting from its virtual card for online purchases. Keep in mind that here we will have a maximum limit of 600 euros and we need to have a bank account as such. The minimum recharge that we can make on this virtual card is 6 euros and we can pay online at no cost.

Vivid virtual card

One of the main characteristics that this virtual card offers us is that we can use it without any identification. This means that the card as such does not have a number, CVV, or expiration date. All the associated data is found in the mobile application of vivid where we will have to open an account. The only cost that this card has is one euro for its issuance.