If you have to pay in your tax return, there are different methods to comply with your obligations. We tell you what are the main options you can choose.

On April 3, the 2023 income campaign. As every year around this time, the doubt about the possibility of paying once we present the draft can become a major concern, depending on the amount to be paid. The Tax Agency, at the time of submit our declarationoffers us by default the possibility of split the payment in two installments. Assuming in the first of them 60% of the total and, in the second, the remaining 40%. But, did you know that there are different methods to proceed with the payment of the result of our declaration?

Different options

The most common way to pay income tax is through direct debit. However, the tax organization offers us other options that may better adapt to our situation and that are included in this link.

The first of them is via credit card. Once we prepare the declaration and proceed to submit it, we must access the “Self-assessment” payment option found in the “Pay, defer and consult debt” section. In that section, we can choose card payment as a payment method, as the Tax Agency itself says in this link. We will have to select what is the issuing entity and enter the card details. When we have everything entered, the next step is to accept the data and continue with the process. If we have chosen to split the payment into two installments, we will only have to pay the first of them. If we have chosen not to split the debt, we can make the entire payment in the same operation.

Another option is by Bank transfer. This option is only available to taxpayers who opt for non-face-to-face entry and do not have an account in their name with any collaborating entity. The taxpayer has to accept a payment commitment and obtain the data that is necessary to be able to make the transfer from their financial institution. It is important to keep in mind, as the organization warns, that if the payment is made from a collaborating entity, it will be returned to the account of origin, with the legal consequences that non-compliance with the payment obligation entails.

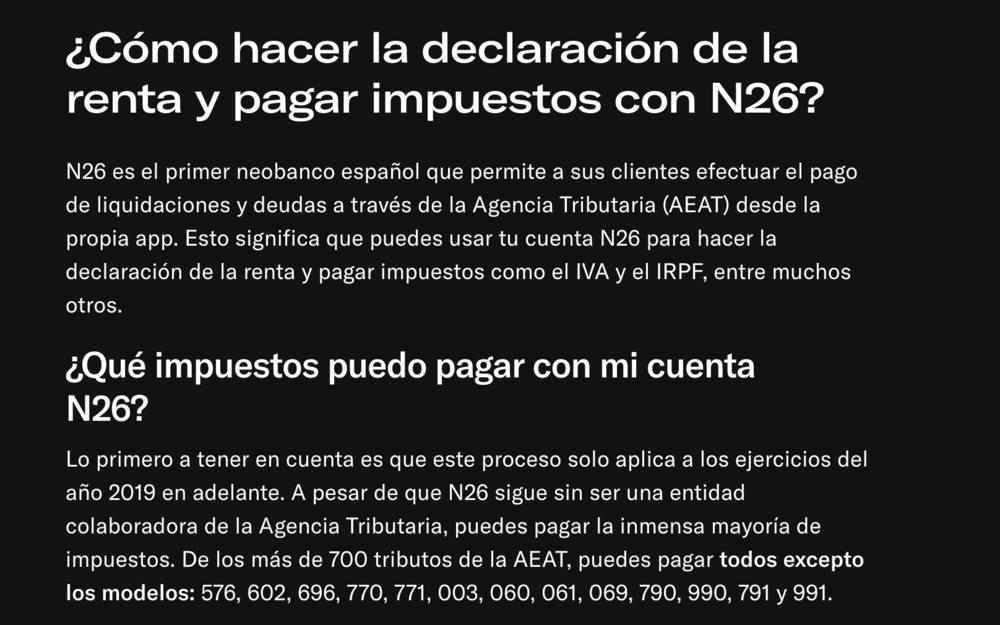

The Tax Agency will provide us with the amount, the concept that we must include, the IBAN and the deadline for receipt. In this linkthe Tax Agency remembers that the payment will be considered made on the date on which the transfer is received by the organization and as long as said date is within the limit reception indicated. In banking entities like N26, even we found a manual that will guide us step by step throughout the entire process.

In-person payment

Finally, the Tax Agency also has the option of make payment in person in a collaborating entity with the income document, thinking of all those who cannot or do not want to have to pay the payment electronically.

Once we validate the income tax return, we must click on the option that says “To enter with a deposit document for Bank/Caja”, whether we choose to split it or if we choose to pay everything in a single installment. A PDF will be generated that will show us the barcode that we must deliver to the bank in order to make the corresponding payment based on the result of our declaration.