The cryptocurrency market is once again tinged with red and practically all altcoins lose between 10 and 25 percent as a result of the problems that Binance is having with the US regulator. At the moment, the Chinese platform has announced that as of June 13 it will suspend all withdrawals of deposits in dollars, causing what is commonly known as “corralito”.

The digital asset sector is once again experiencing a perfect storm after the SEC (Securities and Exchange Commission of the United States) sued the two main cryptocurrency exchanges, Binance and Coinbase. In the case of the American company, the regulator maintains that the company works without authorization to operate as a broker, causing consumers to be unprotected. According to the SEC, Coinbase has made billions of dollars trading cryptocurrencies without being licensed. The markets quickly reacted to the measure adopted by the regulator and Coinbase left 15% on the stock market and accumulated an 85% drop since it went public in April 2021.

More serious is the situation of Binance, the first exchange platform worldwide and a reference for the listing of all digital assets. In this case, the regulator considers that the Chinese company led by Changpeng Zhao violates multiple laws in the United States and considers it a “deception network” that, among other accusations, “artificially inflates its trading volumes”, “diverts assets from its clients evading the controls of the authorities” and even accuses its founder of participating in “money laundering” operations. A total of thirteen charges that have caused the collapse of all cryptocurrencies and the departure of more than 800 million dollars from Binance that have been withdrawn by its clients.

Playpen in sight

The Chinese company has been forced to publish a statement accusing the United States of using aggressive and intimidating tactics with the aim of attacking the cryptocurrency industry. Likewise, it has announced that users will not be able to deposit or withdraw their cryptocurrencies in dollars, causing what is known as corralito. The problem is not only that users are abandoning the platform and withdrawing tens of millions, the rest of the banking partners have also announced that they will pause the cash injection channels with the Chinese platform.

Bitcoin and other cryptocurrencies collapse

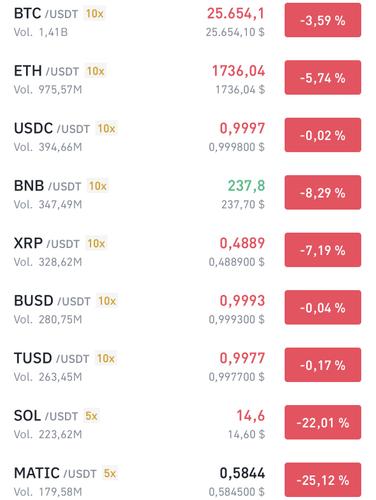

The war against the two main platforms has had an almost immediate impact with massive sales in the most speculative assets and with a significant drop in Bitcoin of more than $1,000. At the time of writing this article, this is the current situation.

The bad news every day is also undermining the confidence of investors who are getting rid of the so-called “altcoin” and accumulating Bitcoin, which is precisely the cryptocurrency that suffers the least despite the storm. Users are using unregulated platforms such as Kucoin, Mexc, Bybit, etc. to make sales and accumulate everything in the main currency, which has barely corrected 4% in the last 24 hours but has significant support at $25,000. In the event that the price breaks through that level, it could visit $20,000, again spreading panic and dragging the rest of the projects to new lows.

Are there reasons to distrust Binance?

The Chinese company has always been very opaque with its accounts and it is impossible to know if the SEC’s accusations are true or not because it is clear that the US regulator wants to put a stop to digital currencies and its president is the most hated by the community. The reality is that if Binance falls, the crypto ecosystem will be mortally wounded and the crashes could be historic. At the moment there is no reason to leave the platform if you are invested in it, but it is always important to apply the saying “do not have all your eggs in one basket”.

Most affected altcoins

Investors are reducing their risk exposure and some of the most volatile and well known currencies are falling the most. Thus, for example, Solana loses 23%, Matic 27%, Cardano 25% or FTM 20%. Other well-known projects such as Polkadot also corrected double digits, 12%, EGLD 13% or Rose, which also fell 13%. The good news is that both Bitcoin and Ethereum are trying to ride out the downpour and are correcting 4-6% respectively.