Buying online inside and outside the EU is not the same. When paying for any product that comes from outside the European Union, the truth is that there are different aspects that must be taken into account before buying anything, such as whether you have to pay tariffs, whether it includes VAT… among other points. . No matter how much you see that it is a real bargain, you always have to be very careful.

With online shopping, a new world has opened up, especially because you can find more discounted products and stores that you may not have known about until then. But what happens when buying outside the EU from Spain? For you to understand it well, you need to know a series of tips so that the purchase does not turn out to be more expensive than you thought.

Check taxes and shipping costs

Thanks to the Internet, users have the possibility of purchasing products from different parts of the world. For example, you can buy online in a store in the United States from Spain or, as usual, buy from a seller in China from our country. However, there are different factors that must be considered if you want the purchase to not be more expensive than expected.

For example, before paying anything, check that the payment includes VAT. And, in many cases, the seller from outside the EU may not include the payment of taxes. The good thing is that a large part of online sales platforms indicate it perfectly, while in other cases it does not always appear. For this reason, if the VAT of origin has not been charged, once it enters Spain, Customs will require you to pay 21% of the VAT, so it will take longer to receive the product and the cost will increase.

In addition to paying taxes, another point that online buyers often do not take into account is that, if the value of the product to be sent exceeds €150, then the cost of tariffs must be assumed. If you do not want to have problems, since the purchase is from a non-EU website and is of great value, the best thing is to present a declaration of value that can cover it if any problem arises.

Beware of customs scam

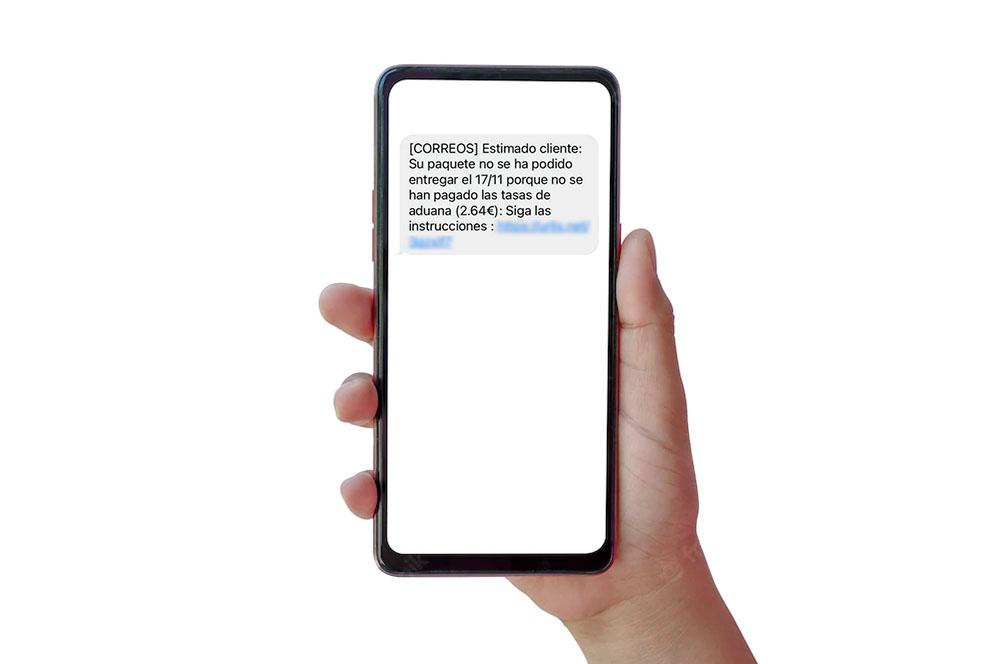

Not only do you have to take into account VAT and possible tariffs for online purchases outside the EU, you also have to be aware of possible scams. Among them, the most widespread is the one that tries to scam users with false customs payments.

If you receive a notification about import costs via SMS, it is probably a phishing attack that only seeks to steal personal information and your banking details. First of all, they pretend to be the Post Office. Keep in mind that customs can be paid when the postman passes by your house or at a Post Office. If you receive a message on your mobile phone asking you to carry out this type of procedure, it is better to be suspicious than to fall into the trap.

Furthermore, if you have any incident with the Post Office, it will always tell you a package number with which you can find out about it on the postal service website. If you receive an SMS and there is no reference number, it is most likely fake. So be careful.