The present 2024 comes with several changes for the self-employed. In addition to the obligation of having to submit the Income Tax return, regardless of the volume of income, the contribution bases also change. We tell you.

On January 1, 2023, the Royal Decree-Law 13/2022 of July 26, 2022, through which a new contribution system was established for self-employed or self-employed workers. Since that moment, the self-employed in our country have begun to contribute based on their net income and, therefore, has led to a change in the cost of self-employed contributions.

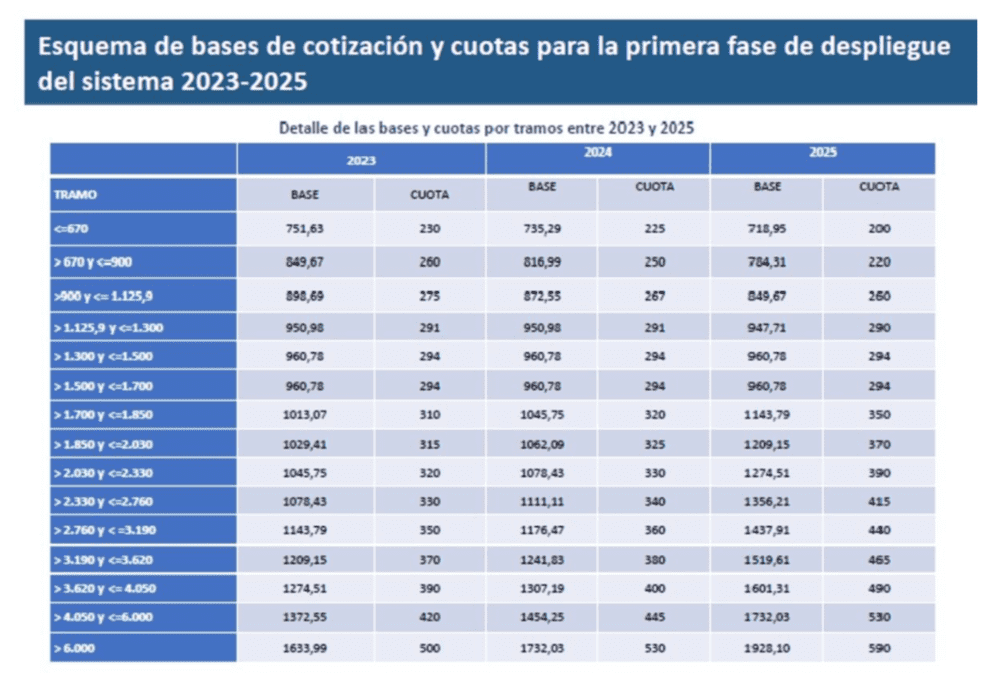

In general, this 2024 the fee is minimally reduced in the lower sections, while it increases in all the upper sections. In the intermediate sections, the quota remains the same as in 2023. It is a contribution system that is based on a progressive quota model which started in 2023 and will have a transition period of nine years, until 2032. Although, as of today, we only know the quotas for the current 2024 and those for the next academic year, 2025. From 2026 onwards, it is still not known. has reported what the evolution will be.

225 euros minimum fee

For this year, the fees will decrease minimally compared to those that were active in 2023 in the lowest sections. The minimum fee will be 225 euros, while in 2023, this was 230 euros. In 2025, the minimum fee will continue to drop to 200 euros.

However, in the highest reaches we find the opposite path. While in 2023, the maximum fee was 500 euros, This year it will be 530. In 2025, the maximum fee will be 590 euros. In this case, these would be self-employed workers who declare more than 6,000 euros per month, with a contribution base of 1,928.10 euros.

If we look at the central sections of the table, Those self-employed workers with net income between 1,850 and 2,030 euros, with a contribution base of 1,062.09 euros, would have to pay a fee that would be 325 euros. Ten euros more than in 2023, but 45 euros less than what they will have to pay in 2025.

More changes

At the end of the fiscal year, when the annual net returns are known, a regularization of contributions will be carried out. Returning or claiming the calculated amount of the installments until they adjust to their final net returns. However, it is worth knowing that it is possible to voluntarily change sections up to six times a year.

Finally, it is worth remembering that this will be the first year in which the self-employed must submit the Income Tax Return. All those people who have been registered in 2023, even if it is a single day, will have to pMandatory filing of the Income Tax Return in 2024 and the successive ones. Until this rule came into force, the range from which it was necessary to make said declaration depended on the level of income.