On November 8, Telefónica will celebrate its Capital Markets Day and we will learn first-hand about the future plans of the Spanish operator. On the table is a perfect storm flying over the telecommunications sector that in recent years has destroyed billions of euros. What can we expect?

In just a few days, the Spanish telecom company faces its investor day with all eyes on the strategic plan designed by José María Álvarez-Pallete for the next three years. The “Investor Day” comes in the midst of a whirlwind of news related to the emergence of Saudi Arabia in the company’s shareholding through STC and the more than probable entry of the SEPI (State Industrial Property Company) with the aim of defending the strategic interest of the company.

Why doesn’t the Government want STC to acquire 10% of Telefónica?

The entry of STC, an operator whose main owner is the Saudi sovereign fund, took the entire sector by surprise last August. Neither Telefónica nor the Government knew of the plans of the largest telecommunications company in the Middle East. Once the intentions were known, some members of the Government in coalition roles quickly shouted to the sky, implying that the strategic companies for Spain must be owned by the state. The Generalitat of Catalonia, key partners of the Government, also did not like that a fund chaired by Crown Prince Mohammed bin Salman takes such a relevant stake in a company that has important defense contracts and that manages strategic communications.

To stop the acquisition of 10% and limit Saudi entry, the Government proposes that SEPI be the one to acquire 5% of the company for 1,000 million euros. The operation is not simple, the Government wants an industrial partner to participate in the operation and also the entry of the executive on the board of the operator raises certain doubts in the business environment. Most of the IBEX 35 companies are facing the executive due to the huge amount of taxes they are facing. Multinationals such as Repsol and some banks have already warned that they will reduce their investments in Spain if the tax pressure continues to increase.

With this panorama, Telefónica reaches its key day without even knowing if STC is going to acquire 10% of the company or if the Government is going to become a shareholder in the company through SEPI.

Uncertainty in two key markets: Germany and Spain

The Spanish telecom must also explain the plans it has for both markets, which are being closely watched by all analysts. On the one hand, there is Germany, which received a major blow last summer when Vodafone took the wholesale contract of its main client, One&One. On the other hand, the merger of MásMóvil with Orange that has not yet been closed, the acquisition of Vodafone by Zegona and the more than possible loss of the wholesale contract with Digi are some of the dark clouds that the operator has on the horizon. The good news is that Spain continues to be Telefónica’s driving force worldwide and the operator’s performance at a national level is spectacular. Despite the very tough competition in the market, Movistar is growing in fiber customers and defends better than any other high-value customers who are the ones that contribute the bulk of the income. In addition, the Spanish operator has other levers that allow it to generate new income: fiber network, television, football, alarms and a lower churn (customer loss rate) than other competitors.

Light at the end of the tunnel

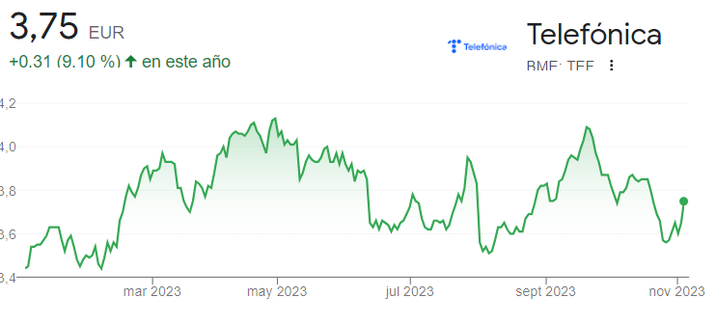

Telefónica has revalued 9% throughout 2023 but has been below the revaluation of the IBEX 35, which has risen 11%. The operator must explain to the market key aspects such as the levers it will use to continue reducing the high level of debt in an environment in which interest rates may continue to rise. It must also explain whether or not it is going to make changes to the dividend policy that has already been put under review by giants like JPMorgan. No less important are the future expectations, which is what really interests the analysts and above all the million shareholders who have purchased shares of the Spanish telecom company. We will see all this next November 8th.