If you are self-employed or are going to be, you are surely wondering if something has changed or is going to change for you with the new Social Security contribution system. A system that came into force on January 1, 2023 and that will change the fee you pay month by month as a freelancer. Luckily, there is a simulator that will allow us to get an idea of how much we are going to have to pay or how much we would pay.

One of the main advantages of the Social Security self-employment fee simulator is that we do not need to give our data or register, so it can be very useful if we have been offered a job and we want to get an idea of how much we are going to have to pay. month to month. We can do all the tests we want taking into account our income forecast.

How to access the simulator

The first thing we have to do is access the 2023 self-employed quota simulator through the Social Security website. The steps are simple because we simply have to go to the corresponding website and search for it.

- We go to the website of the General Treasury of Social Security

- Scroll until you find the section “Self-employment”

- Click on the corresponding arrow to go to this section

- You will see frequently asked questions and all kinds of questions…

- Scroll on the page

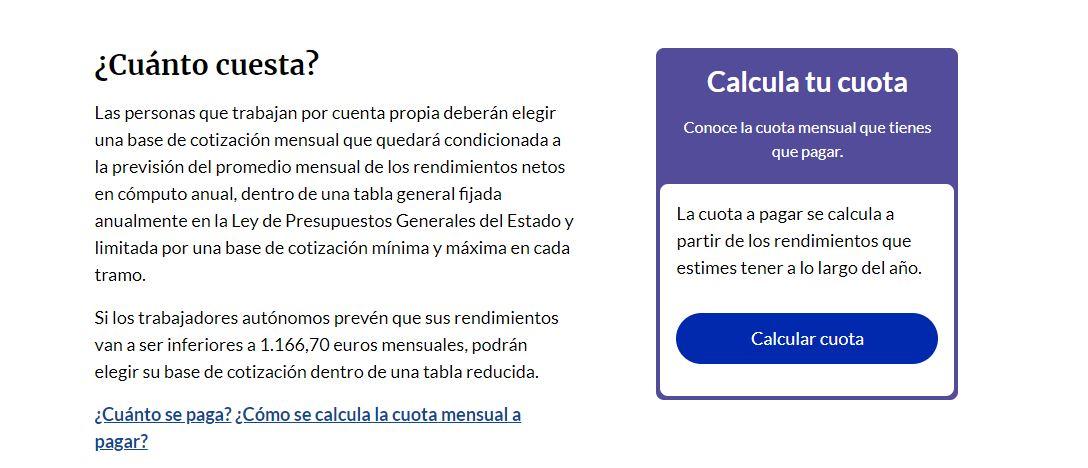

- At the bottom, look for the “Calculate your fee” section

- As in the image, tap on the button in this box

Once here, we will already be inside the calculator and we can start using it. As we have said in previous paragraphs, you do not need registration or any type of identification so you can repeat the process as many times as you want.

How to use

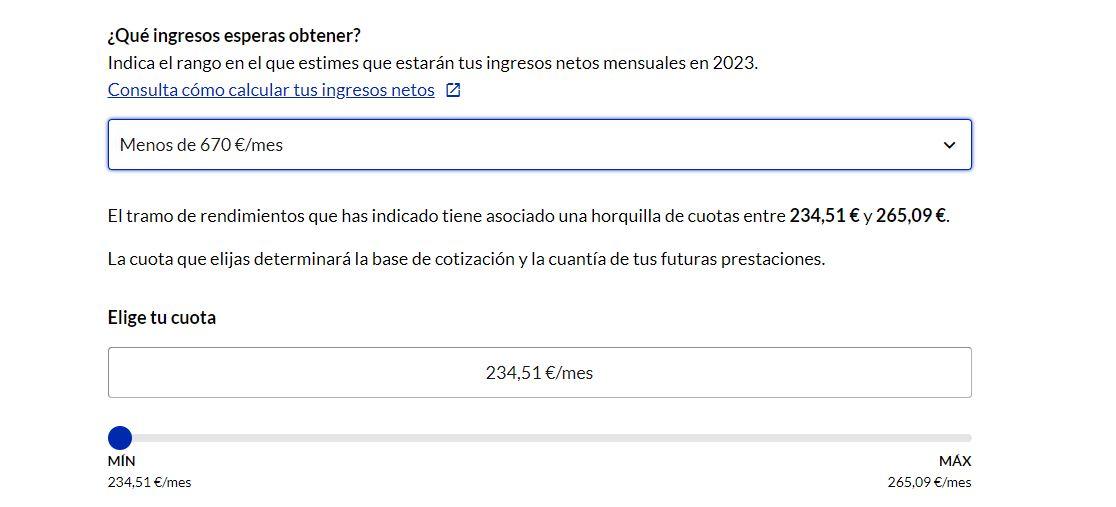

From the simulator they indicate that it is an “informative” simulation and that the fee to be paid will be shown without applying deductions, so you can get an idea but the result may vary slightly depending on other factors.

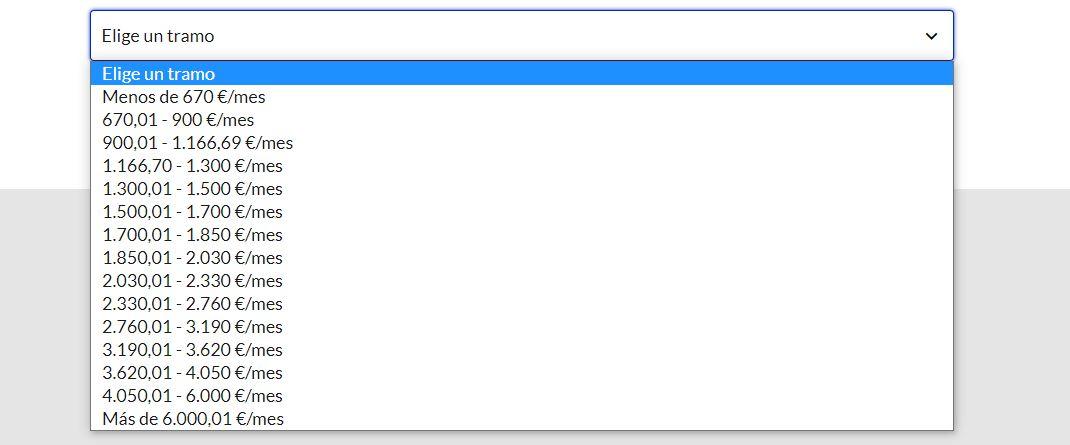

If you have already reached the calculator, the first thing to choose is the income you expect to obtain. Indicate the range that you estimate to have in 2023 between less than 670 euros per month and more than 6,000 euros per month. Choose from the drop down menu.

Once here, the calculator will give us a quota range. You will be able to see from the minimum quota to the maximum quota that you will have to pay month by month to Social Security. We can move the drop-down control to get an idea of the fee without discount and its contribution base. From 234 euros per month to 509 euros per month, approximately, it depends on income.

In addition, at the end of the web page we find a series of information for all those who are going to be self-employed or already are. For example, we will be able to access a link where they will tell us what rights are generated with the payment of the monthly self-employment fee or what are the benefits to which we have rights.